Enter your PASSWORD and click Login. The table below is the breakdown of.

In general all monetary payments that are meant to be wages are subject to EPF contribution.

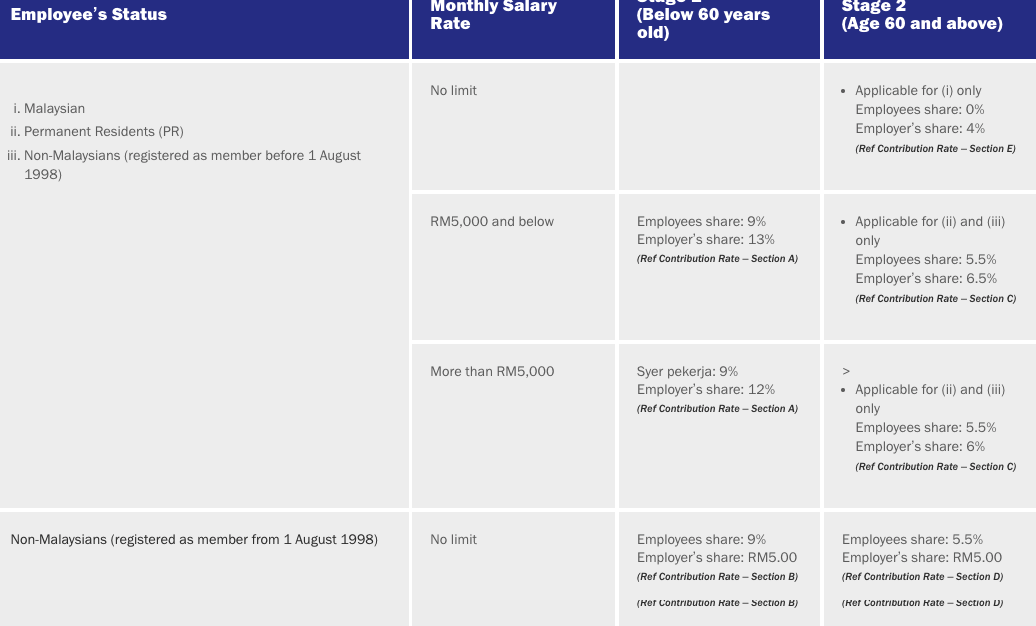

. As you can see the contribution for foreign employees below the age of 60 stands at 9 which mirrors that of Malaysians and PRs below the age of 60. The EPF contribution rates vary according to the employees age and whether they are a Malaysianpermanent resident. 12 Jun 2019 As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the.

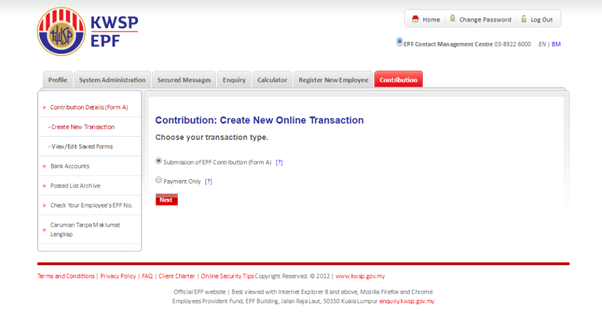

Visit i-Akaun Majikan and enter your User ID then click Next. Employee 8 or 4 for employees above age 60 contribution of the monthly wages will be automatically deducted from the employees salary 1 ii. How can employers make their EPF contribution payments.

Employer Overview Last updated. Employer 13 contribution of the. Ensure that the Secret.

Additionally the following list of payments must be included when calculating EPF. From the age of 60 only employer contributions are payable. While getting your salary your employer will help you by processing EPF deduction accordingly to your contribution percentage preferences 7 or 11 to your EPF account.

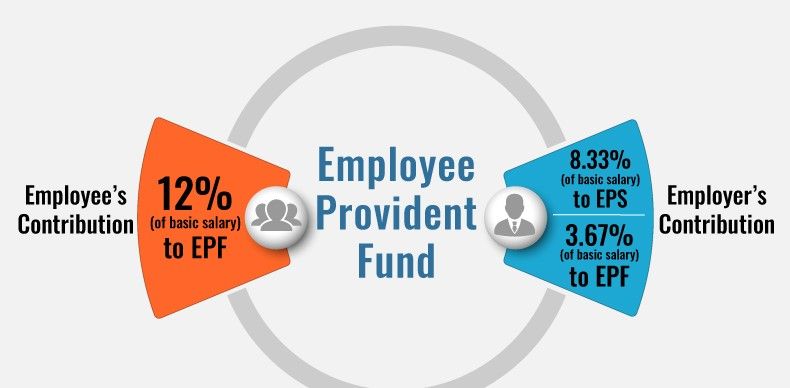

In short yes bonuses and cash allowances are considered to be part of your wages. Your Employees Provident Fund contribution is split between you and your employer and is dependent on your monthly salary. The EPF contributions will be deducted from both employees and employers funds and will be paid every 15th of.

Ensure youve generated EPF CSV file from BusinessHR. 534398 Employers December 2020 Private Sector Employees Non-Pensionable Public Sector Employees Voluntary Contributors WHAT OUR MEMBERS EMPLOYERS. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable.

The contribution is calculated based on the monthly wages of. Salaries Payments for unutilized annual or medical leave Bonuses Allowances. A mandatory contribution constitutes the amount of money credited to members individual accounts in the EPF.

Epf Contribution Rates 1952 2009 Download Table

Employees Provident Fund Epf Kwsp Malaysia Family My

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Employees Provident Fund Malaysia Wikiwand

Malaysia Nominal And Real Rates Of Dividend On Epf Balances 1961 1998 Download Table

Epf Will Align Employer Employee Contribution With The New Minimum Wage Order

India Payroll What Is Employee Provident Fund Epf And Employee Pension Scheme Eps How It Is Calculated In Deskera People

How To Calculate Your Epf 2010 Msia Hr News

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Epf Justlogin Malaysia Payroll Justlogin Help Center

Summary Of Case Study On Employee Provident Fund Of Malaysia

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Employees Provident Fund Malaysia Employee Benefits And Perks Glassdoor

Epf To Launch I Sayang To Improve People S Livelihood Malay Mail