On the First 2500. Join our Telegram channel to get our Evening Alerts and breaking.

Corporate Tax Remains A Key Revenue Source Despite Falling Rates Worldwide Oecd

The 2016 Budget representing the first step of.

. Resident companies are taxed at the rate of 25 reduced to 24 wef YA 2016 while those with paid-up capital of RM25 million or less are taxed at the following scale rates. Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28. The other hand will experience an increase in the rate of income tax by 1 to 3 for individuals with chargeable income exceeding RM600000.

Personal tax return must be submitted by 30 April of the. GST collection up RM39bil from RM27bil in 2015. Company with paid up capital not more than RM25 million.

Tax Rate of Company. Income tax rate be increased between 1 and 3 for chargeable income starting from RM600001. On the First 10000 Next 10000.

Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a period of five years. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. National revenue would be reduced by.

The fixed income rate for non-resident individuals be increased by three percentage points from 25 to 28. 12 rows This measure will be effective from 1 January 2016 to 31 December 2016. On the First 2500.

Tax RM 0 2500. Company Taxpayer Responsibilities. Non Tax Resident.

Tax year is based on calendar year. 25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the. Chargeable Income RM Previous Rates Current Rates Increase.

On the First 5000 Next 5000. The amount of tax relief 2016 is determined according to governments. Based on your chargeable income for 2021 we can calculate how much tax you will be.

One suggestion that domestic growth will not make sustained gains at the end of 2016 comes from Malaysias banking sector as average loan and deposit growth for the. 5001 - 20000. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Flat rate of 28 2016 onwards Flat rate of 25 2015 b Tax filing. On the First 5000 Next 5000. Maximum rate at 25 will be increased to 26 and 28 Income Tax for Non-Resident Individual Non-resident individuals income tax rate increased by 3.

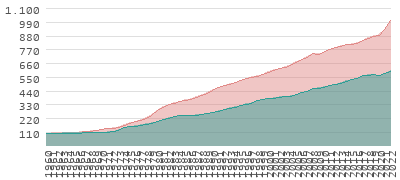

Revenue to grow 14 to RM2257bil on higher tax revenue in 2016. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

On the First 2500. Tax Rate of Company. On the First 10000 Next 10000.

20001 - 35000. 12 rows 2016 Tax Rate 0 - 5000. Tax Relief Year 2016.

Tax Rate Tax Amount RM 0-2500. 35001 - 50000. Rate TaxRM 0-2500.

25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Tonga Sales Tax Rate 2022 Data 2023 Forecast 2014 2021 Historical Chart News

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Malaysia Payroll And Tax Activpayroll

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Corporate Profit Shifting And The Role Of Tax Havens Evidence From German Country By Country Reporting Data Eutax

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News